One of the benefits that the Philippine Social Security System offers its members is the Salary Loan. This SSS loan is a privilege that the agency gives to its active members who require assistance with short-term financial needs. The question is, how to get a loan in SSS?

What Are the Benefits of a SSS Salary Loan?

SSS members who need help with their short-term finances can opt to avail a Salary Loan.

SSS members who need help with their short-term finances can opt to avail a Salary Loan.

Under this type of SSS loan, members are entitled to borrow an amount equivalent to their 1- or 2-month salary. The actual loan value shall be computed based on the average monthly salary of the member over the last 12 months of employment. This amount is subject to a 10% interest rate.

A service charge for SSS loan processing amounting to 1% of the total amount will also be collected. The borrowing member shall then begin making payments on the second month following loan approval, with the total amount amortized over a period of 24 months.

Payments for this SSS loan may be made directly to the SSS or to any of its accredited banks. If the member is presently employed, payment remittances shall be made through the employer.

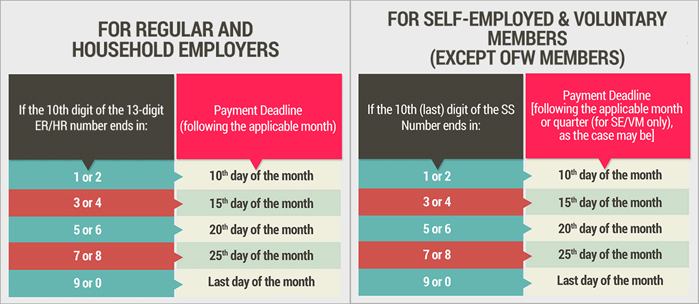

Payment deadline for loans | Image: SSS

Payment deadline for loans | Image: SSS

SSS loan requirements: Who can avail?

In order to avail of the Salary Loan, there are certain requirements listed by the SSS. Briefly, these are the requirements for a member to qualify for this type of SSS loan.

- The SSS member must be presently employed, self-employed or a voluntary member who is updated in his or her contributions, with the corresponding total number of payments varying based on the duration of the loan.

- For a 1-month SSS loan – Minimum of 36 monthly contributions, with at least 6 contributions made within the last 12 months prior to the loan application

- For a 2-month SSS loan – Minimum of 72 monthly contributions, with at least 6 contributions made within the last 12 months prior to the loan application

- Payment of contributions and loans must be handled with the member's employer if the member is employed. Other SSS debts that the member owes must also be paid on time.

- In the case of borrowers who are employed, their employers must also be updated in their contribution payments.

- Members must be 64 years old and below in order to qualify for this SSS loan.

- The borrowing member should not have collected any permanent disability, retirement or death benefits from the SSS.

- The member should not have a record of disqualification due to fraud committed against the agency.

Do you qualify for a SSS loan? Read this to find out.

Do you qualify for a SSS loan? Read this to find out.

READ MORE:

SSS Maternity Benefits: Paano Ka Makakakuha Nito?

Paano nga ba mag-apply ng calamity loan sa SSS?

Iba’t ibang uri ng loans na makakatulong sa nagigipit na miyembro ng SSS

SSS Loan requirements: How to Apply for a SSS Loan

How to loan to SSS? In order to avail of a salary loan from SSS, members must completely fill out a Member Loan Application form. They can submit this form to the SSS branch closest to their place of work or residence.

SSS Online Loan Application Member Login

This can also be done online, provided that the member is registered for a My.SSS account. For online applications, members should also make sure that their employers are enrolled for an SSS web account so that employers can issue the necessary certification via the web portal.

Together with the form, members must present their SSS IDs or E-6 Forms. Finally, members must also be able to present at least two valid IDs. Both identification cards must contain a specimen signature, and at least one of the two should have a photo. For a list of accepted IDs, you may visit the SSS website here.

How to apply for SSS Online Loan Application Member Login

- Go to the SSS’s website.

- At the home page, click Member under the title, Portals.

- Click on “Not yet registered in my SSS?”

- Read the reminders.

- Certify that you have read and understood the reminders then proceed with the registration

- Fill up the required information:

- CRN/SS Number

- Email Address

- Preferred User ID

- Fill up the next form:

- Surname

- Given Name

- Middle Name

- Date of Birth

- Scroll down and continue to fill up the required field:

- Mailing Address

- Foreign Mailing

- Address

- Choose the Registration Options/Preference

- Tutorial on Page 9

- An email will be sent to your registered email address.

- Click “clicking here” to be directed to the password setup page.

- Encode the last 6 digits of your CRN/SS Number then click “Submit”.

- Encode your preferred password.

- The length must be 8-20 alpha - numeric characters.

- First character must be alphabetic.

- No special characters.

- Password must be different from your User ID.

- Sample: JDCruz08

- Upon clicking submit, you will be directed to your account page

- View your account’s home page.

SSS Loan Status

SSS loan processing takes around 2-3 weeks from the date of application provided that all information and attachments are complete. Self-employed or voluntary members will be advised when they can pick up their checks from the SSS branch. Employed members’ checks will be given through their employers.

There also are several other SSS loan types available, and you can learn more about these on their website.

Amount & Terms of Loan: SSS Loan Application

Photo by Andrea Piacquadio

Photo by Andrea Piacquadio

The lesser of a member's last twelve (12) Monthly Salary Credits (MSC) or the amount sought constitutes a one-month loan.

A two-month loan is equal to the lesser of double the average of the member's last twelve (12) Monthly Salary Credits (MSC), rounded up to the next higher MSC, or the loan amount.

The loan will have a ten percent (10%) annual interest rate until it is fully paid, and will be amortized over 24 months, depending on the diminishing principal balance.

SSS Calamity Loan

Qualified members can apply for a loan equal to one month's salary credit (MSC) based on the average of their last 12 monthly salary credits (MSCs) rounded up to the nearest thousand or the amount they applied for, whichever is smaller, under the CLAP.

Calamity Loan Requirements

To be eligible, affected members must meet the following SSS Calamity Loan requirements:

- Visit www.sss.gov.ph to register for My.SSS;

- Make at least 36 monthly contributions, six of which must be made within the prior 12 months of submitting the application;

- A resident of an NDRRMC-declared calamity-affected region who suffered property damage or loss as a result of Typhoon Odette;

- No final benefit has been awarded, such as permanent total disability or retirement;

- Have no outstanding LRP or CLAP loans;

- If the member is employed, the CLAP application must be confirmed by the member's employer via My.SSS.

- CLAP applicants can submit an application through their My.SSS account.

Members' approved loan proceeds will be credited to their accounts via their registered Unified Multi-Purpose Identification (UMID) – Automated Teller Machine (ATM) Card, active accounts with a PESONet participating bank, or their Union Bank of the Philippines (UBP) Quick Cards registered in the Disbursement Account Enrollment Module (DAEM), which can be found on their My.SSS accounts.

Over the course of two years, the loan will be repaid in 24 equal monthly installments. It has a ten percent yearly interest rate and has previously eliminated the service fee of one percent of the loan amount.

SSS Pension

Qualified retired pensioners can borrow three, six, nine, or twelve times their basic monthly pension (BMP) plus the P1,000 extra bonus. The loanable amount, however, must not exceed the maximum loan limit of P200,000. Furthermore, the take-home earnings of the pensioner-net borrower must be at least 47.25 percent.

Six and twelve months, respectively, shall be the payment term for a pension loan equal to three and six times the pensioner's BMP plus the P1,000 extra benefit. The repayment period for a pension loan of nine or twelve times the BMP plus the P1,000 additional benefit is 24 months.

After SSS accepts the loan, the retiree's first monthly amortization will be due on the second month. The first monthly amortization will be withdrawn from the pensioner's monthly pension in October if the loan is issued in August.

The annual interest rate on pension loans will be 10%, computed on a falling principal balance until the loan is entirely paid. It has a lower interest rate than those available on the open market, which can be as high as 20%. SSS does not ask pensioner borrowers to give their ATM cards in exchange for loan installments, unlike certain private loan organizations.

Retirees must meet the following requirements to be eligible for the loan program:

- At the end of the loan period, you must be 85 years old or younger;

- no outstanding loan amounts or overpayments of Social Security benefits;

- no current advance pension under the SSS Calamity Assistance Package;

- To be deemed "active," they must have received their regular monthly pension for at least one month.

Those who are qualified for renewal can now submit their applications through the SSS website's My.SSS Member Portal.

Housing Loan

The SSS Housing Loan is intended for qualified members to apply for in order to finance the purchase of a house and land, home remodeling projects, or the assumption of home loans. SSS provides a range of home loan alternatives to meet diverse needs.

SSS housing loan requirements

To avail the loan, a member should have at least 36 monthly contributions and 24 continuous contributions before the loan application.

Additionally, applicants must be insurable and not older than 60 years old. If you're older than 60, you will have a maximum loan term of five years.

Moreover, to apply for a housing loan, you must have no existing SSS housing loan and has not been granted final SSS benefits.

Furthermore, you also need to have an up-to-date payments of other SSS loans if you have any. And you should have no SSS or NHMC repair and/or improvement loan.

Loan Amount

Depending on the form of home loan, you can borrow up to ₱2 million. You are eligible to borrow up to ₱450,000 for the Socialized Housing Loan. In the meanwhile, you can borrow between ₱1 and ₱2 million using a Low-Cost Housing Loan.

The borrower's genuine need, capacity, and the appraised value of the collateral (at least 70% but not over 90%) will determine the amount of the approved SSS Housing Loan.

If three eligible SSS members share collateral and are related within the first degree of consanguinity or affinity, they may pool their loanable limits.

Here are the housing loan options you can avail of depending on your needs:

- Direct Housing Loan Facility for Workers' Organization Members

- Direct Housing Loan Facility for OFWs

- House Repair/Improvement Loan

- Assumption of Mortgage

Updates by Margaux Dolores and Jobelle Macayan